Page 72 - 360.revista de Alta Velocidad - Nº 6

P. 72

Givoni, Moshe. Chen, Xueming.

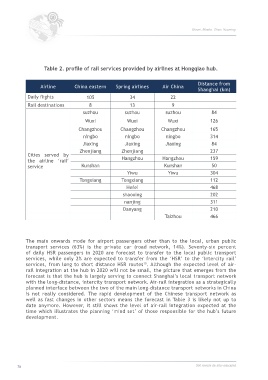

Table 2. profile of rail services provided by airlines at Hongqiao hub.

Distance from

Airline China eastern Spring airlines Air China

Shanghai (km)

Daily flights 105 34 22

Rail destinations 8 13 9

suzhou suzhou suzhou 84

Wuxi Wuxi Wuxi 126

Changzhou Changzhou Changzhou 165

ningbo ningbo ningbo 314

Jiaxing Jiaxing Jiaxing 84

Zhenjiang Zhenjiang 237

Cities served by

the airline ‘rail’ Hangzhou Hangzhou 159

service Kunshan Kunshan 50

Yiwu Yiwu 304

Tongxiang Tongxiang 112

Hefei 468

shaoxing 202

nanjing 311

Danyang 210

Taizhou 466

The main onwards mode for airport passengers other than to the local, urban public

transport services (63%) is the private car (road network, 14%). Seventy-six percent

of daily HSR passengers in 2020 are forecast to transfer to the local public transport

services, while only 2% are expected to transfer from the ‘HSR’ to the ‘Intercity rail’

10

services, from long to short distance HSR routes . Although the expected level of air-

rail integration at the hub in 2020 will not be small, the picture that emerges from the

forecast is that the hub is largely serving to connect Shanghai’s local transport network

with the long-distance, intercity transport network. Air–rail integration as a strategically

planned interface between the two of the main long-distance transport networks in China

is not really considered. The rapid development of the Chinese transport network as

well as fast changes in other sectors means the forecast in Table 3 is likely not up to

date anymore. However, it still shows the level of air–rail integration expected at the

time which illustrates the planning ‘mind set’ of those responsible for the hub’s future

development.

70 360.revista de alta velocidad