Page 154 - 360.revista de Alta Velocidad - Nº 6

P. 154

Beckerich, Christophe. Benoit, Sylvie. Delaplace, Marie.

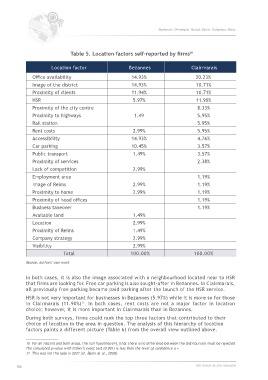

Table 5. Location factors self‐reported by firms

10

Location factor Bezannes Clairmarais

Office availability 14.93% 20.23%

Image of the district 14.93% 10.71%

Proximity of clients 11.94% 10.71%

HSR 5.97% 11.90%

Proximity of the city centre 8.33%

Proximity to highways 1.49 5.95%

Rail station 5.95%

Rent costs 2.99% 5.95%

Accessibility 14.93% 4.76%

Car parking 10.45% 3.57%

Public transport 1.49% 3.57%

Proximity of services 2.38%

Lack of competition 2.99%

Employment area 1.19%

Image of Reims 2.99% 1.19%

Proximity to home 2.99% 1.19%

Proximity of head offices 1.19%

Business takeover 1.19%

Available land 1.49%

Location 2.99%

Proximity of Reims 1.49%

Company strategy 2.99%

Visibility 2.99%

Total 100.00% 100.00%

Source: authors’ own work.

In both cases, it is also the image associated with a neighbourhood located near to HSR

that firms are looking for. Free car parking is also sought‐after in Bezannes. In Clairmarais,

all previously free parking became paid parking after the launch of the HSR service.

HSR is not very important for businesses in Bezannes (5.97%) while it is more so for those

in Clairmarais (11.90%) . In both cases, rent costs are not a major factor in location

11

choice; however, it is more important in Clairmarais than in Bezannes.

During both surveys, firms could rank the top three factors that contributed to their

choice of location in the area in question. The analysis of this hierarchy of location

factors paints a different picture (Table 6) from the overall view outlined above.

10 For all factors and both areas, the null hypothesis H (that there is no difference between the distribution) must be rejected.

0

The calculated p‐value with Fisher’s exact test (0.001) is less than the level of confidence α =

11 This was not the case in 2007 (cf. Bazin et al., 2009).

152 360.revista de alta velocidad