Page 525 - 360.revista de Alta Velocidad - Nº 6

P. 525

High Speed Railway in Saudi Arabia: Lessons to be learnt from the Spanish experience

other transport alternatives and therefore HSR can become a better option. Second, related

to the first one, once the ramp up period is over and traffic is consolidated the Tran Operating

Company (TOC) has certain degree of control over demand: commercial speed, frequencies

and price prove it. However, ceteris paribus HSR demand seems to anticipate economic cycles.

The increment in traffic in 2013 is explained by the yield management prices introduced by

Renfe. Third, the ramp up period usually lasts the first two years once the infrastructure fully

open. As we have already seen after that point two factors influence demand: GDP growth and

TOC’s policy. For instance, in the Madrid – Barcelona route the first year traffic growth was huge

(255.78%), similar to the first year of Madrid to Seville (246.8%), whereas for other routes it

was lower with Madrid to Malaga (139.5%) and Madrid to Valencia (149.1%) with similar traffic

growths (Fernandez, 2012). These figures do not match figures in the table because the first

year of full operation is not the calendar year (e.g. Madrid – Barcelona route was opened on

20 February 2008).

th

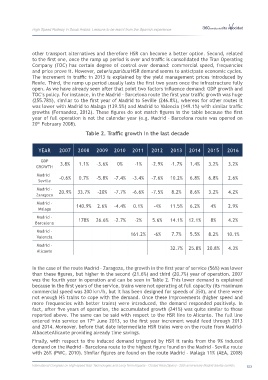

Table 2. Traffic growth in the last decade

YEAR 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

GDP 3.8% 1.1% -3.6% 0% -1% -2.9% -1.7% 1.4% 3.2% 3.2%

GROWTH

Madrid – -0.6% 0.7% -5.8% -7.4% -3.4% -7.6% 10.2% 6.8% 6.8% 2.6%

Seville

Madrid –

Zaragoza 20.9% 33.7% -20% -7.7% -6.6% -7.5% 8.2% 8.6% 3.2% 4.2%

Madrid –

Malaga 140.9% 2.6% -4.4% 0.1% -4% 11.5% 6.2% 4% 2.9%

Madrid –

Barcelona 178% 26.6% -2.7% -2% 5.6% 14.1% 12.1% 8% 4.2%

Madrid –

Valencia 161.2% -6% 7.7% 5.5% 8.2% 10.1%

Madrid – 32.7% 25.8% 20.8% 4.3%

Alicante

In the case of the route Madrid – Zaragoza, the growth in the first year of service (56%) was lower

than these figures, but higher in the second (21.6%) and third (20.7%) year of operation. 2007

was the fourth year in operation and can be seen in Table 2. This lower demand is explained

because in the first years of the service, trains were not operating at full capacity (its maximum

commercial speed was 200 km/h, but it has been designed for speeds of 350), and there were

not enough HS trains to cope with the demand. Once these improvements (higher speed and

more frequencies with better trains) were introduced, the demand responded positively. In

fact, after five years of operation, the accumulated growth (241%) was quite similar to those

reported above. The same can be said with respect to the HSR line to Alicante. The full line

entered into service on 17 June 2013, so the first year increment would feed through 2013

th

and 2014. Moreover, before that date intermediate HSR trains were on the route from Madrid-

AlbaceteAlicante providing already time savings.

Finally, with respect to the induced demand triggered by HSR it ranks from the 9% induced

demand on the Madrid – Barcelona route to the highest figure found on the Madrid – Seville route

with 26% (PWC, 2010). Similar figures are found on the route Madrid – Malaga 11% (AEA, 2008)

International Congress on High-speed Rail: Technologies and Long Term Impacts - Ciudad Real (Spain) - 25th anniversary Madrid-Sevilla corridor 523