Page 228 - 360.revista de Alta Velocidad - Nº 6

P. 228

Kim, Junghwa. Li, Yeun-Touh. Schmöcker, Jan-Dirk.

1. Introduction

Taiwan high-speed rail (THSR) opened its operation from 2007. The system primarily relies

on imported rolling stock from Japan and supplemented with European traffic management

system. Through connecting the island’s economic corridor north to south, serving almost 90%

of the industry and the population. It had progressively reformed Taiwan into a “One-day living

circle”. The nearly 350 kilometers investment has significantly reduced the travel time from

4 hours into 1.5 hours, which the interregional accessibility of the Western coast Taiwan has

naturally improved (Li et al. 2015).

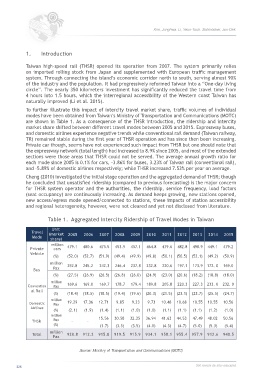

To further illustrate this impact of intercity travel market share, traffic volumes of individual

modes have been obtained from Taiwan’s Ministry of Transportation and Communications (MOTC)

are shown in Table 1. As a consequence of the THSR introduction, the ridership and intercity

market share shifted between different travel modes between 2005 and 2015. Expressway buses,

and domestic airlines experience negative trends while conventional rail demand (Taiwan railway,

TR) remained stable during the first year of THSR operation and has since then been increasing.

Private car though, seems have not experienced such impact from THSR but one should note that

the expressway network (total length) had increased to 8.9% since 2005, and most of the extended

sections were those areas that THSR could not be served. The average annual growth ratio for

each mode since 2005 is 0.1% for cars, -3.86% for buses, 3.23% of Taiwan rail (conventional rail),

and -5.89% of domestic airlines respectively; while THSR increased 7.53% per year on average.

Cheng (2010) investigated the initial stage operation and the aggregated demand of THSR; though

he concluded that unsatisfied ridership (compared to previous forecasting) is the major concern

for THSR system operator and the authorities, the ridership, service frequency, load factors

(seat occupancy) are continuously increasing. As demand keeps growing, new stations opened,

new access/egress mode opened/connected to stations, these impacts of station accessibility

and regional heterogeneity, however, were not cleared and yet not disclosed from literature.

Table 1. Aggregated Intercity Ridership of Travel Modes in Taiwan

Unit

Travel (market 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

Mode share)

million

Private cars 479.1 480.6 475.5 453.9 457.1 464.8 479.6 482.8 498.9 449.1 479.2

Vehicle

(%) (52.0) (52.7) (51.9) (49.4) (49.9) (49.8) (50.1) (50.5) (52.1) (49.2) (50.9)

million 252.8 245.2 242.3 246.4 237.8 232.8 220.6 197.1 173.9 172. 0 169.0

Bus Pax

(%) (27.5) (26.9) (26.5) (26.8) (26.0) (24.9) (23.0) (20.6) (18.2) (18.8) (18.0)

million

Convention Pax 169.6 169.0 169.7 178.7 179.4 189.8 205.8 220.3 227.3 233. 0 232. 0

al Rail

(%) (18.4) (18.5) (18.5) (19.4) (19.6) (20.3) (21.5) (23.1) (23.7) (25.5) (24.7)

million

Domestic Pax 19.29 17.36 12.71 9.85 9.23 9.73 10.48 10.68 10.55 10.55 10.56

Airlines

(%) (2.1) (1.9) (1.4) (1.1) (1.0) (1.0) (1.1) (1.1) (1.1) (1.2) (1.0)

million 15.56 30.58 32.35 36.94 41.63 44.53 47.49 48.02 50.56

THSR Pax - -

(%) (1.7) (3.3) (3.5) (4.0) (4.3) (4.7) (5.0) (5.3) (5.4)

million

Total 920.8 912.2 915.8 919.5 915.9 934.1 958.1 955.4 957.9 912.6 940.5

Pax

Source: Ministry of Transportation and Communications (MOTC)

226 360.revista de alta velocidad